Fannie and Freddie in 2025 - Part 2

Discussing the possible futures for the companies. A future IPO depends upon the federal government deciding to take less than it is owed, according to its bailout terms.

My Part 1 on Fannie and Freddie is here

One big thing to understand about Fannie and Freddie’s future is that any change in their current status means the federal government takes less than it is legally owed, for the benefit of common shareholders who should have probably been wiped out long ago.

Whether that is good or bad depends on how you see the world. Also it depends on whether any future deal is struck to mostly benefit common shareholders, or mostly benefit the US Treasury (which is ultimately us taxpayers), or strikes a reasonable balance between the two.

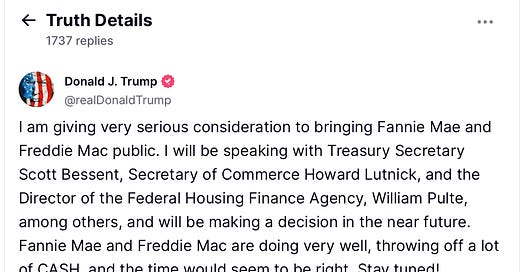

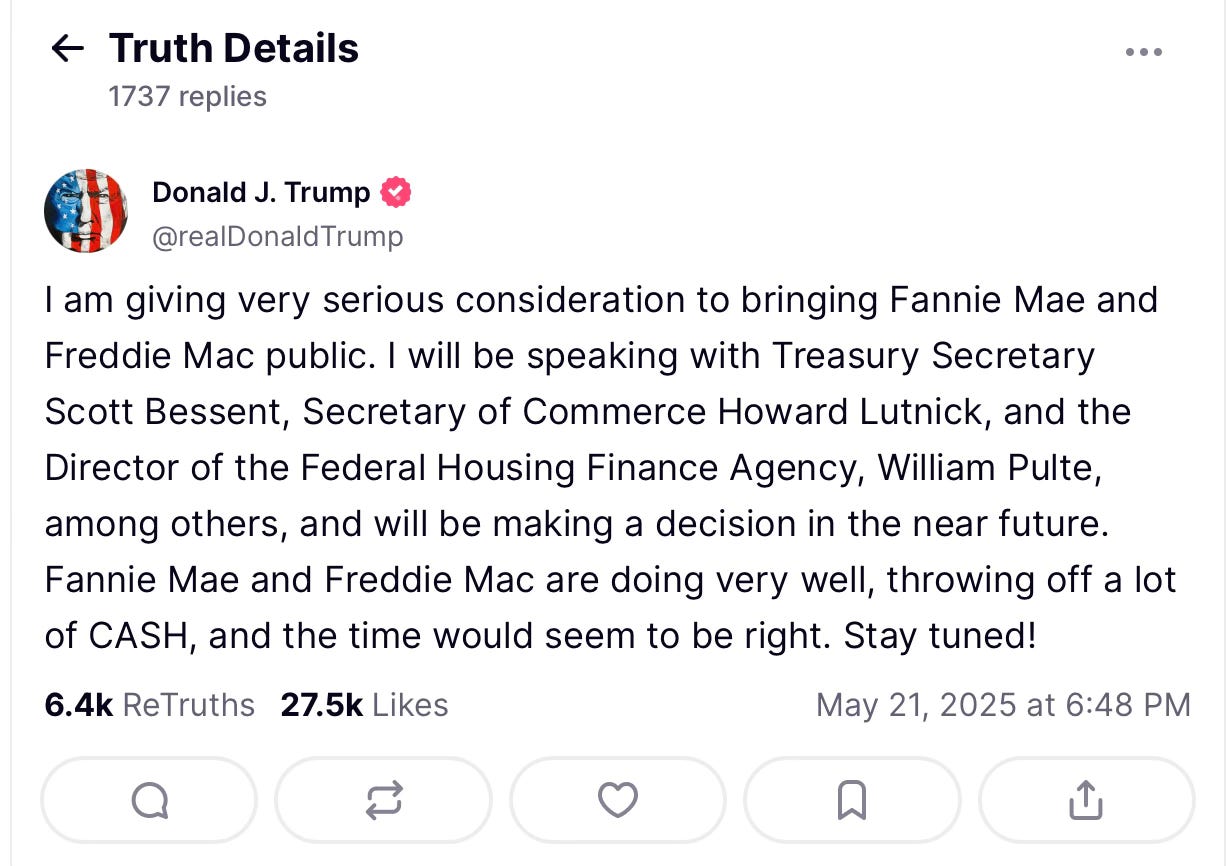

We are beginning to see the outlines of any deal for Fannie and Freddie to leave conservatorship. Starting with a Truth Social announcement from the big guy at the top, who loves making deals.

Why do we care?

One reason to care is that there’s a lot of money at stake. The annual dividends that the federal government can earn through ownership of Fannie and Freddie per year is roughly $30 billion. The amount that the two companies owe the federal government to fully repay their obligations is $340 billion and growing. Whether the federal government receives those amounts, or compromises with private shareholders and takes less, ought to be understood by more people. If the companies were held by common shareholders, that $30 billion could be earned by them, but presumably after compensating the US Treasury (which again is us taxpayers)

Another reason upcoming changes to Fannie and Freddie are worth paying attention to is because they are a good way to explore what businesses ought to be public, versus what businesses ought to be private, versus what ought to be a hybrid business. Fannie and Freddie were hybrid private/public companies before, with both benefits and curses from this model. They are currently wholly government owed, but that is fixing to change in the coming year or two. The nature of the hybrid future is partly the topic of a Part 3 post.

In the context of dramatic cost-cutting measures such as the DOGE task force, the $340 billion+ owed the US Treasury by Fannie and Freddie to exit conservatorship merits significant debate.

The specific history of how that large amount came about is relevant to how decision-makers will decided on splitting up benefits between shareholders and US Treasury.

Here is a quick history of the companies with respect to common shareholders and whether the companies can hold on to their capital rather than send it to the Treasury.

Pre-2008 - They are owned common shareholders and act like private companies. (Although with an implicit government guarantee which made them hybrid businesses.)

2008 - They are placed into a conservatorship of their regulator, with initially a $1 billion capital injection which came with the government’s rights to purchase 79.9% of the shares of the company at any time, plus a $100 billion special preferred shares given to the US Treasury investment, with a 10% dividend payments on the $100 billion special preferred shares. This bailout would seem to wipe out existing common shareholders. (ah, but wait!)

2012 - To the extent the companies could not afford to pay the full 10% dividend in the 2009 to 2012 time period, they are obligated to pay everything they can. Any profits in the future not paid to Treasury are added to the amount owed to Treasury to satisfy the special preferred shares obligation.

2017 - Fannie and Freddie are allowed to retain up to $3 billion capital and not send everything to Treasury.

2019 - Fannie and Freddie are allowed to retain up to $25 billion in capital and not send everything to Treasury. By 2019, the total amount ever disbursed to Fannie and Freddie from Treasury was $191 billion, while the total amount ever received by Treasury from Fannie and Freddie was $301 billion. That makes these bailout “investments” the most profitable of the 2008 crisis bailouts (compared to AIG, GM, Bank of America, Chrysler, Wells Fargo, JP Morgan for example) and a cash-on-cash return of 11.6% between 2008 and 2019.1

2021 - Fannie and Freddie are allowed to stop sending dividend payments to Treasury entirely, and their retained capital can increase indefinitely. This was done presumably with a goal of building up the companies’ internal capital so that they could eventually break free from the government’s guaranty of all their debt obligations. Even so, the terms of the deal are that all annual profits are added to any future amount that they would pay to Treasury to satisfy their special preferred shares obligation. At the end of 2024 that amounted to approximately $340 billion owed.

2025 - Trump indicates interest in doing a deal to privatize the companies, and the largest common shareholder Bill Ackman, an active Trump supporter, makes the case for doing a giant re-IPO of Fannie and Freddie. So that’s where we are now.

Current common shareholders

Bill Ackman, billionaire hedge fund owner of Pershing Square Asset Management, is the ringleader of current common shareholders. It’s accurate to say he is acting on his own behalf, with ancillary benefit to other smaller shareholders, if he gets his way.

From a distance, and according to a normal reading of the bailout terms since 2008, the common shareholders of Fannie and Freddie should have been wiped out. In simplest terms that’s because when a company is obligated to send all of its current profits and all of its future profits to someone (in this case the US Treasury/taxpayers) who ranks higher than common shareholders, then by definition the common shares are worthless. But that’s not the way the market perceives the common shares, and that’s not the way Bill Ackman perceives the common shares his company owns.

Ackman of Pershing Square Asset Management has been advocating heavily for a change in status from conservatorship to something more like a public-shareholder owed company in which investors could benefit from profits, rather than have them accrue to the benefit of the federal government in perpetuity. Basically, he’s advocating for a re-IPO of the companies to raise capital and move the companies away from conservatorship to a normal status company. And some forgiveness of the $340 billion owed for the special preferred shares obligation.

Ackman made a presentation in January 2025 justifying this change. A summary of his pitch is that:

These companies are essential to the US housing and mortgage markets.

They are profitable and, at this point, low-risk companies.

The amount of past payments plus government proceeds from privatization would more than compensate taxpayers for the 2008 bailout.

Profitable companies should be allowed to be in private hands, not government-owned.

Capital requirements for newly-privatized GSEs should be lower than traditional banks and should be in the 2.5% range, because the business of guaranteeing mortgage bonds is less risky than the traditional bank business. Higher capital requirements would be inefficient and would end up being passed through in the form of higher borrowing costs for homeowners.

The recapitalized and re-IPOd GSEs could still represent $300 billion in value for the federal government, which could sell its close-to 80% of the shares in the companies over the 5 years following an IPO.

If the government exercised its right to convert its current senior preferred shares into common equity, and wiped out current shareholders, that would trigger litigation (from people like Ackman) and would signal to other future investors in GSEs that they shouldn’t get involved in the companies. So the federal government shouldn’t do that. Instead, the government should allow current shareholders to reap the benefits of holding on since 2008, and own a piece of the newly floated companies. And cut a deal on the special preferred shares for less than the amount owed and for the benefit of common shareholders.

President Trump, for his part, seemed to endorse hedge fund manager Ackman’s position in the Truth Social post of May 2025.

Long before that, in November 2021, Trump penned a letter to Senator Rand Paul in which he expressed sympathy for the idea of privatizing Fannie and Freddie.

Trump, in his usual rhetorical style, lambasts Obama/Biden, sees government ownership as Socialism, claims unconstitutional limits to his power, wants to fire someone, and looked forward to doing a big beautiful deal to re-privatize the mortgage giants. So we get the gist of his views in 2021, which are reinforced by the presentation by Ackman. Ackman for his part understands the assignment. He names his January 2025 presentation “The Art of the Deal” and concludes with the final page:

Ok, Ackman. Anyway.

All that makes it likely that a deal will get done. The tricky part for common shareholders is that someone (some combination of President Trump, Treasury Secretary Bessent, Commerce Secretary Luttnick, FHFA head Pulte) has to come up with a plan to pay US taxpayers less than $340 billion, because to do that would wipe out any value for common shareholders.

Future IPO deals for Fannie and Freddie could include $20-30 billion in share sale proceeds, which would make them either the largest or second largest US share offering of all time. Once re-floated, the federal government’s stake could be worth $200-250 billion if they exercised their rights to own 80% of the companies.

According to the terms of the special preferred shares, however, that still wouldn’t satisfy the $340 billion and growing obligation to repay. So there’s a deal to be cut somewhere.

Your view on what should happen, what Bill Ackman’s motives are, what Trump’s motives are, and where the relative balance of benefits should go between American taxpayers and stock market investors are probably somewhat preset by your political and financial priors.

I have some priors, of course, but also I think these are honestly complex issues and true trade-offs. Since the scale is so huge ($300+ billion in taxpayer value, $30 billion in profit per year) I think more people should be paying attention.

These numbers courtesy of Bill Ackman’s Pershing Square Asset Management presentation.